Table of Content

There is also a Depreciation section for those who want to use it, but it can also be ignored. Aside from owing less on your home, there are other advantages to putting at least 20% toward your down payment, such as not having to pay private mortgage insurance . If you put down less than 20%, you’ll need to pay PMI because lenders see the loan as higher risk. A good rule of thumb is that your total mortgage should be no more than 28% of your pre-tax monthly income. You can find this by multiplying your income by 28, then dividing that by 100. The debt-to-income ratio is your minimum monthly debt divided by your gross monthly income.

The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income. Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgage’s annual interest calculation, lenders include valuation fees and redemption fees.

Affordability

We offer a variety of mortgages for buying a new home or refinancing your existing one. Our Learning Center provides easy-to-use mortgage calculators, educational articles and more. And from applying for a loan to managing your mortgage, Chase MyHome has everything you need. Results of the mortgage affordability estimate/prequalification are guidelines; the estimate is not an application for credit and results do not guarantee loan approval or denial. At 25 to 50 basis points higher, you’re looking at rates of between 3.0% to 3.25% in the US and between 2.69% to 2.94% in Canada for a second home.

As always, it pays to shop around and be ready to lock in a rate if you find one that seems competitively low. Borrowers with a 5/1 ARM of $100,000 with today’s interest rate of 5.45% will spend $565 per month in principal and interest. Before you sign, dealerships will try to add “recommended extras” onto the invoice price. These typically include a $1,000 ceramic coat, $1,000 for a GPS anti-theft device, and $100 for nitrogen in the tires. Credit card test, where the dealer will charge you for every nick and scratch bigger than a credit card.

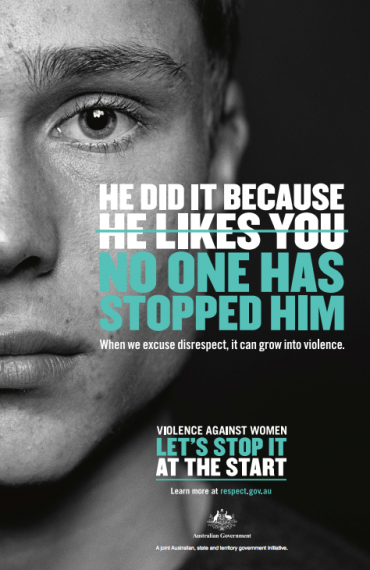

Help to Buy Equity Loan

Reduce debt in other areas—This may include anything from choosing a less expensive car to paying off student loans. In essence, lowering the standard of living in other areas can make it more possible to afford a particularly sought-after house. For example, if you make $3,000 a month ($36,000 a year), you can afford a mortgage with a monthly payment no higher than $1,080 ($3,000 x 0.36).

If you want an excellent TransUnion rating, your credit score must fall between 628 to 710. To assess your financial records, lenders usually use three major credit reference agencies . While there are other CRAs, these are most preferred by lenders across the UK.

CFPB Shifting From DTI Ratio to Loan Pricing

The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household's risk for conventional loans. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans. It is highly recommended that you speak with a lender or loan professional of your choice about your mortgage loan needs and to help determine your home affordability. Realtor.com provides information and advertising services – learn more. Learn more about the line items in our calculator to determine your ideal housing budget.

Our guide will discuss vital factors that determine your mortgage affordability. We’ll also talk about the importance of maintaining a good credit score and how major credit issues hinder chances of favourable mortgage rates. We’ll give a rundown on the required debt-to-income ratio, deposit, and primary costs you must consider before taking a mortgage. If you’re looking for effective government schemes, we also included a section on Help to Buy mortgage assistance programs. Your estimated annual property tax is based on the home purchase price. The total is divided by 12 months and applied to each monthly mortgage payment.

Frequently Asked Questions About Mortgages

Using a percentage of your income can help determine how much house you can afford. For example, the 28/36 rule may help you decide how much to spend on a home. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. All home lending products except IRRRL are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice.

Within that period, you should be able to cover your monthly payments before the insurance pays for your mortgage. On the other hand, the back-end DTI accounts for your housing-related expenses along with all your other debts. This includes car loans, student loans, credit card debts, etc. Front-end DTI is seldom used by lenders for mortgage applications.

This assures lenders they are securing a home for the right amount. It’s a fee charged for the mortgage application, which is paid whether your loan was accepted or not. It’s also called the reservation fee and is sometimes included into the arrangement fee. Depending on the location and the size of the property, home prices may be a lot higher. In January 2021, The Guardian reported that the average London house price exceeded the £500,000 mark for the first time.